依據歐盟施行的個人資料保護法,我們致力於保護您的個人資料並提供您對個人資料的掌握。

按一下「全部接受」,代表您允許我們置放 Cookie 來提升您在本網站上的使用體驗、協助我們分析網站效能和使用狀況,以及讓我們投放相關聯的行銷內容。您可以在下方管理 Cookie 設定。 按一下「確認」即代表您同意採用目前的設定。

Latest News

中銀文摘

2018-05-28

區塊鏈專區

區塊鏈與虛擬貨幣法律專題(七)

【Zhong Yin Law Firm, Partner Charlotte Wu / Associate Arthas Ke/ Consultant Joseph Banks】

charlotte.wu@zhongyinlawyer.com.tw

charlotte.wu@zhongyinlawyer.com.tw

Legal risks of launching an Initial Coin Offering (ICO) in Taiwan – A look at Taiwan’s Banking Act, Securities Exchange Act, Money Laundering Control Act

【Cryptocurrency Legal Risks】

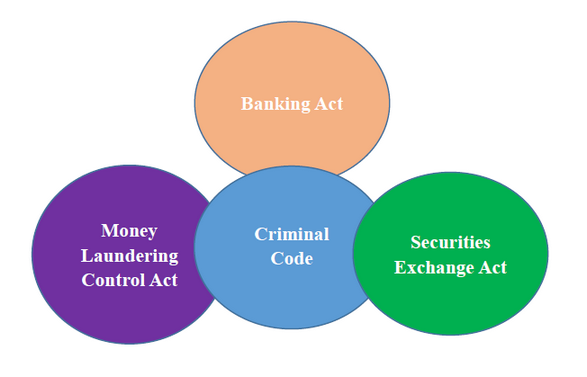

In prior articles, we have discussed cryptocurrencies generally and have provided an overview of the regulations regarding cryptocurrencies and ICOs in other countries. In this article, we will specifically focus on the regulations and laws that would apply to cryptocurrencies and ICOs in Taiwan. In Taiwan, there are four main pieces of legislation that will affect the operation of a cryptocurrency or the launch of an ICO in Taiwan. They are the Criminal Code, Banking Act, Securities Exchange Act, and Money Laundering Control Act. Each act has certain provisions and requirements that require strict compliance and attention.

【Anti-Fraud Crime centered legal liability】

The main focus on ICO/cryptocurrency regulation is to determine if the ICO/cryptocurrency at issue is providing false or misleading information to consumers. An additional concern is the threat of cryptocurrency being used as a tool to launder money. As cryptocurrency is a relatively new phenomenon that is based on secrecy, governments around the world have been struggling on how to prevent cryptocurrency from being used in money laundering. Taiwan’s Criminal Code contains an anti-fraud clause and should be viewed as the central and fundamental law related to cryptocurrency and ICOs. This anti-fraud clause is further addressed in the Banking Act, Securities Exchange Act, and Money Laundering Control Act. Committing “fraud” in Taiwan is an offense punishable by up to seven (7) years imprisonment. Founders and other entrepreneurs who are either personally in Taiwan, or who have operations in Taiwan, should be very careful and deliberate in following all appropriate regulations.

(Graph 1:Interlocking laws related to ICOs and Cryptocurrency)

【Banking Act:Non-Banking entities acceptance of deposits】

According to Article 29 (1) of Taiwan’s Banking Act “Unless otherwise provided by law, any organization other than a Bank shall not Accept Deposits, manage Trust Funds or public property under mandate or handle domestic or foreign remittances.” Article 29 (1) further states that “Using borrowed money, accepting investments, making the depositor a shareholder or using other classifications in order to accept deposits or obtain capital from the general public by agreeing to pay or paying a bonus, interest, share dividend interest or other reward in an excessive amount, shall be deemed the act of Accepting Deposits”. Additionally, Article 125 (1) clarifies that “Those who violate Article 29, Paragraph 1, of this Act shall be punished by imprisonment for not less than three (3) years and not more than ten (10) years, and may be fined a criminal fine of not less than Ten Million New Taiwan Dollars (NT$10,000,000) and not more than Two Hundred Million New Taiwan Dollars (NT$200,000,000). “

Pursuant to the regulations mentioned above, if a cryptocurrency’s issuer or an exchange trading a specific cryptocurrency is not a bank, and such an issuer or exchange accepts cryptocurrency or fiat currency from the public, such an individual or company may be in violation of the above listed articles of the Banking Act. Bitcoin and Ethereum are assets, and the competent authorities desire to support financial stability. Presently, no cryptocurrency issuers or exchanges have faced any such conviction in Taiwanese courts of law. However, it is very possible that Taiwanese courts may seek to enlarge the scope of the Banking Act to apply to cryptocurrency issuers and exchanges, much like what is happening in the United States presently. We strongly advise our clients to keep the above regulations in mind when dealing with cryptocurrency in Taiwan.

It is important to note that while there have not been any convictions, there are instances in Taiwan where prosecutors are attempting to investigate the operators of cryptocurrency exchanges for violations of the Banking Act. Recently, prosecutors have investigated Kuan-Wei Lu, a founder of a cryptocurrency exchange known as “MY COIN”, for “engaging in the acceptance of deposits as a non-banking entity”, which would be in violation of Articles 29(1), 29-1, and 125(1) of the Banking Act. Allegedly, the defendant allowed investors to transmit BitCoins through MY COIN to the other exchanges around the world. The interesting thing about this case is that the exchange itself is not located in Taiwan, but rather is located in Hong Kong demonstrating the potential extraterritoriality of this law. While the outcome of the case is not determined at the time of writing, it is a good example of how a party dealing with cryptocurrency in Taiwan may violate provisions of the Banking Act.

Taiwan’s Securities Exchange Act is heavily modeled after the United States’ Securities Act of 1933 and the Securities Exchange Act of 1934. Likewise, the criteria adopted by the courts of the United States to determine if a product, like a distributed ledger technology, is “security” or not can lead to a great impact on how Taiwanese agencies and courts would also act. In United States law, a “security” can be classified as a share, debenture or other well-known type of security, along with a vague term of an “investment contract”. The Supreme Court of the United States, in the landmark case Securities and Exchange Commission v. W. J. Howey Co. determined that an “investment contract” can be very broad and therefore created a three-part test to determine if such a contract or product was an “investment contract”, and thus a security. In order to be considered an “investment contract”, the contract would need to adhere to the following: [1]

- The money invested into the contract was contributed to a common enterprise.

- There is an expectation of profits from such investment.

- Any profit comes from the efforts of a promoter or third party.

Taiwan has also adopted a likewise similar broad approach to defining a “security”, such as “overseas contracts made by foreigners” which can be considered a security under Taiwanese law. Taiwanese law does not distinguish between certain “overseas contracts” and regular securities such as shares or bonds, in either way investors are able to invest money and receive a return on their investment in both. Securities in Taiwan are regulated under the Securities Exchange Act. To issue securities in Taiwan, the issuer must first apply for approval from the Financial Supervisory Commission (the “FSC”) in advance. Additionally, if someone is raising funds to invest in a foreign security, it may fall into the coverage of Regulations Governing Securities Investment Trust Funds, and in that case the issuer must also apply for FSC approval.[2] This example shows that Taiwanese law follows United States law to a large extent.

In Taiwan, there are no specific regulations regarding ICOs currently. However, the FSC recently announced that ICOs and cryptocurrency may be considered “securities” that fall under its jurisdiction, determined on a case-by-case similar to the United States and Singapore.[3] Although this announcement from the FSC did not directly call for the regulation of ICOs under the Securities Exchange Act, it is still a giant step towards placing ICOs under the regulation of the Securities Exchange Act. Therefore, both the cryptocurrency issuers and investors should be aware that the FSC may take further steps towards fully regulating cryptocurrency investments and ICOs.

【Money Laundering Control Act】

In Taiwan’s current regulations, money laundering is defined as: “1. knowingly disguises or conceals the origin of the proceeds of specified unlawful activity, or transfers or converts the proceeds of specified unlawful activity to help others avoid criminal prosecution; 2. disguises or conceals the true nature, source, the movement, the location, the ownership, and the disposition or other rights of the proceeds of specified unlawful activity; or 3. accepts, obtains, possesses or uses the proceeds of specified unlawful activity committed by others.” Therefore, if a criminal uses any strategy to disguise the crime-regarding asset with legal-looking asset to retard the investigation from the judicial power, such actions would be considered money laundering. It is possible that if a criminal were to turn his ill-gotten assets into cryptocurrency, then according to such definitions above, such an action would be considered money laundering. In Taiwan, there was a case where an individual was convicted of money laundering through the use of cryptocurrency.[4] Because of these cases, and similar cases around the world, Taiwan and many other governments are taking increased steps to investigate cryptocurrency.

Currently, there are no regulations which request cryptocurrency issuers or exchange operators to take steps to “know your client” with information gathering, unlike the United States. It is possible that Taiwan may soon follow in the United States’ footsteps.

【Increased offense of Fraudulent in Criminal Law】

Taiwan has also codified the elements of “fraud” in its Criminal Code. The FSC in Taiwan stated that if a cryptocurrency’s offering and trading are based on fraud, the Prosecutor may investigate.[5] It is very important for ICO operational teams and the founders to be very careful of the statements they are making to the public and to their consumers as to avoid any charges of “fraud”.

【FinTech Sandbox】

Cryptocurrencies and ICOs are a complex area of law, but thankfully Taiwan has passed the Financial Technology Innovation Experimentation Act in order to create a Fintech Sandbox. The goal of the sandbox is to allow entities to create financial technology products and operate them inside of the sandbox with relaxed regulations. This may become a great option for ICO and cryptocurrency issuers who are concerned they may have difficulty with the law in Taiwan. Unfortunately, the sandbox has yet to go live but will likely do so soon. Further details on how to apply to the sandbox will be provided later.

Please feel free to contact us for comments or discussions.

Charlotte J.H. Wu 吳婕華律師

charlotte.wu@zhongyinlawyer.com.tw

TEL +886 2 2377 1858 EXT 8888

[1] SEC v W.J.HOWEY COMPANY ,Supreme Court of the United States,1946,326 U.S. 293

[2] Ministry of Finance, Tai-Tsai-Cheng 2, Order No. 6934, 1987.

[3] FSC’s announcement, 2017.12.19.

[4] Taiwan New Taipei Court, Jin-Su-Jhi No.40 Criminal Judgement, 2016.

[5] FSC’s announcement, 2017.12.19